UNION PACIFIC (UNP)·Q4 2025 Earnings Summary

Union Pacific Posts Record Year as Norfolk Southern Merger Looms

January 27, 2026 · by Fintool AI Agent

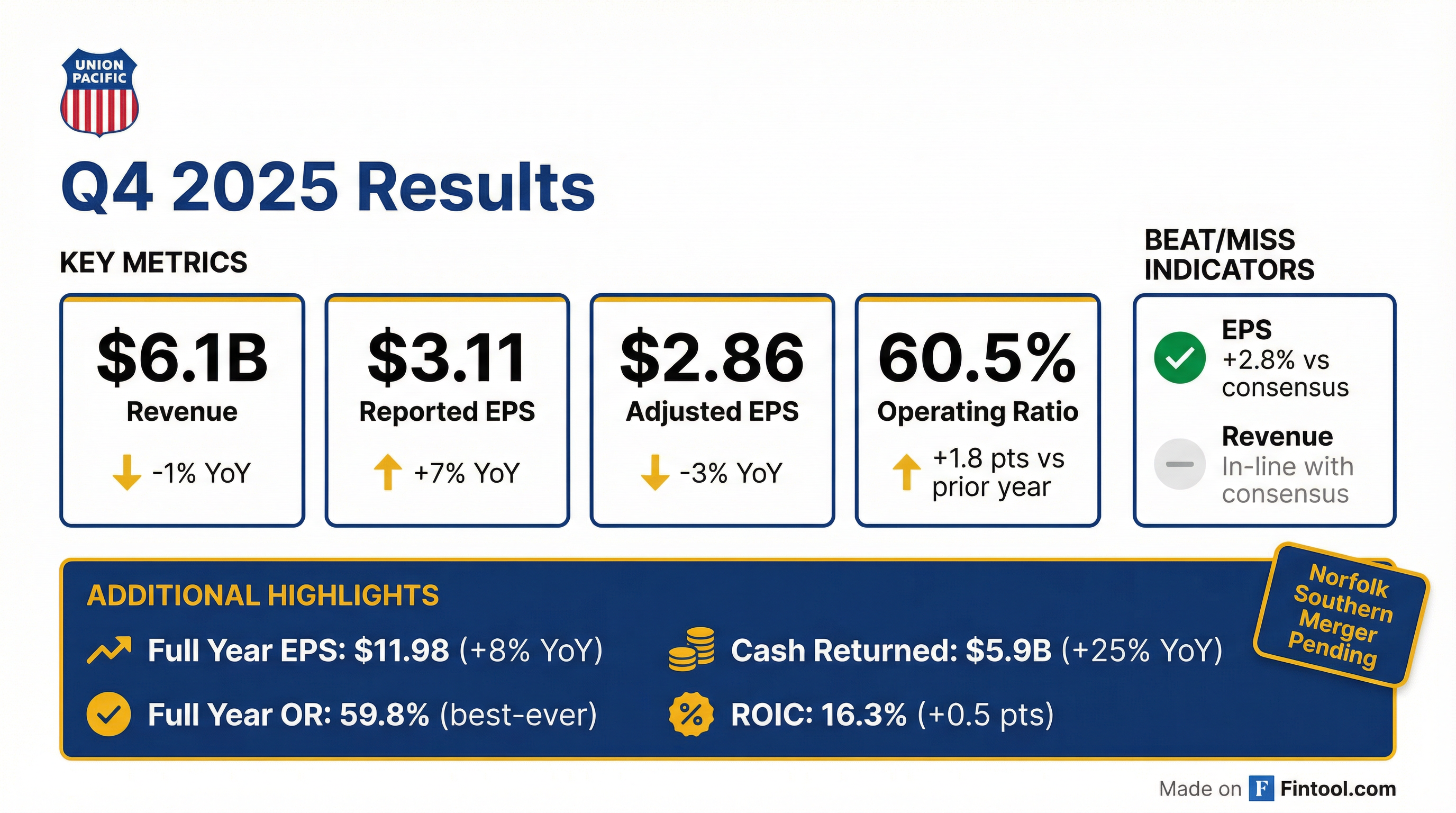

Union Pacific delivered a mixed Q4 2025, beating EPS estimates while revenue came in essentially flat versus expectations. The quarter was overshadowed by strong full-year performance—record safety, record operational metrics, and 8% EPS growth—as the railroad prepares for its transformational Norfolk Southern merger pending regulatory approval.

Did Union Pacific Beat Earnings?

EPS beat, revenue in-line. Union Pacific reported Q4 2025 EPS of $3.11 (reported) or $2.86 (adjusted), compared to consensus expectations of approximately $3.00. The reported figure includes $0.30 per share from industrial park land sales.

The operating ratio deteriorated 180 basis points year-over-year, driven by:

- Merger-related expenses (~$25M/quarter)

- Inflationary pressures

- Casualty expenses

- Partially offset by productivity gains and lower volume-related costs

What Drove Full Year 2025 Performance?

Full year 2025 was Union Pacific's best-ever across safety, service, and operating metrics.

Management highlighted that strong core pricing, increased network fluidity, and volume growth drove the operating ratio improvement on an adjusted basis.

How Did Business Segments Perform?

Volume grew 4% in Q4 while revenue was flat, reflecting mix shifts toward lower-revenue-per-car Premium business.

Key segment drivers:

- Bulk: Coal & Renewables driven by natural gas pricing; Grain & Grain Products benefiting from export soybeans

- Industrial: Chemical & Plastics winning new business and plant expansions offset by weak forest products (housing demand)

- Premium: Strong intermodal volume growth (+10%) partially offset by softer automotive sales

What Did Management Guide for 2026?

Management reiterated confidence in meeting Investor Day targets:

- EPS Growth: Mid-single digit, consistent with the 3-year CAGR target of high-single to low-double digit through 2027

- Operating Ratio: Improvement expected; targeting industry-leading OR and ROIC

- Pricing: Dollars to exceed inflation

- Capital Plan: $3.3B (down from $3.5B in 2025)

- $1.9B infrastructure replacement

- $0.6B capacity & commercial facilities

- $0.4B locomotive & equipment

- $0.4B technology & other

- Shareholder Returns: Continued consistent dividend increases

2026 Financial Assumptions:

- Inflation (ex-fuel): 4% vs 2025

- Fuel price: $2.35/gallon

- Depreciation: Up 4% vs 2025

- Merger costs: ~$25M per quarter

- Tax rate: ~24%

What's the Economic Outlook?

Management cited S&P Global's muted 2026 economic forecast:

The economic backdrop suggests headwinds for volume, particularly in housing-related products and automotive.

What About the Norfolk Southern Merger?

The pending acquisition of Norfolk Southern remains the elephant in the room. Key points from the earnings materials:

- Status: Pending Surface Transportation Board (STB) approval

- Merger costs: ~$25M per quarter currently impacting results

- Risks highlighted:

- Regulatory approval timeline and conditions

- Integration complexity and costs

- Potential for deal termination

- Norfolk Southern's Eastern Ohio incident remediation obligations

- Credit rating downgrade risk

The definitive merger agreement restricts both companies from operating outside ordinary course during the pendency period.

What Were the Key Operational Metrics?

Union Pacific achieved record full-year safety performance and operational efficiency:

Quarterly drivers included record freight car dwell times, improved train speed, reduced car touches, and optimizing the transportation plan.

What Changed From Last Quarter?

Q3 2025 → Q4 2025 Changes:

The operating ratio deterioration was seasonal (Q4 typically weaker) plus increased merger costs. Volume remained solid with 4% growth maintaining positive momentum. Revenue per car declined due to mix shift toward lower-yielding Premium/Intermodal business.

What Did Management Say? Key Quotes

The Q&A session revealed management's confident tone on operations and the merger, while acknowledging near-term headwinds:

On the Norfolk Southern Merger:

"This combination is compelling. It changes the dynamic and the competition. And remember, fundamentally... they're complaining because they're worried about competing against us, 'cause no business would ever complain if somebody in their marketplace was doing something stupid." — Jim Vena, CEO

On Pricing Challenges:

"While we absolutely believe that we will and have a plan to improve our operating ratio in 2026, we don't think that we're gonna get any help from price... We definitely benefited in 2025 from natural gas prices and strong coal pricing. While that may hold, we're just not gonna have that as a tailwind for us in 2026." — Jennifer Hamann, CFO

On Competition and Reciprocal Switching:

"I am not afraid to compete, and I think customers should have optionality. In general, the devil's in the details... But I am very supportive of, if you can't deliver for your customers, then customers should have optionality." — Jim Vena, CEO

On Service Excellence:

"Service drives price." — Jim Vena & Kenny Rocker

Q&A Highlights: What Analysts Asked

Operating Ratio Path in 2026 (Jonathan Chappell, Evercore ISI)

Q: How do you get to OR improvement without pricing help and in a weak macro environment?

A: Jennifer Hamann explained that productivity improvements and favorable business mix will drive margin gains, even without pricing tailwinds. Eric's operational excellence in 2025—workforce productivity, car velocity, locomotive efficiency—will continue delivering in 2026.

Merger Revenue Synergies (Goldman Sachs)

Q: How variable is the $4 billion gross traffic gain, and what costs are associated?

A: Jim Vena confirmed confidence in the 2 million carload growth target from the merger application, noting the team was "conservative" in estimates. Eric added the merger represents only a "6% increase in operating inventory" for the combined entity, which can be absorbed through existing buffer capacity and recent infrastructure investments.

Share Buyback Pause (Ken Hoexter, Bank of America)

Q: Clarify the EPS guidance base and capital allocation.

A: EPS guidance of mid-single digits is based on the $11.98 reported figure. Importantly, Union Pacific has paused $4-4.5 billion in share repurchases to conserve cash ahead of the merger closing.

STB Application Timeline (David Vernon, Bernstein)

Q: When will the application be resubmitted?

A: Jim Vena indicated the response will take "a few weeks" to prepare before refiling. The STB's request focused on three areas requiring clarification, including the "red line" walkaway provision. Management still targets closing in the first half of 2027.

Intermodal Customer Relationships (Chris Wetherbee, Wells Fargo)

Q: How are intermodal partners responding to the merger?

A: Kenny Rocker noted that Hub, Swift, and O&E have all expressed support. The service product investments (Inland Empire, Phoenix, Twin Cities) and record domestic intermodal performance are strengthening customer relationships.

Weather Impact on Q1 (Morgan Stanley)

Q: Can you quantify the winter storm impact?

A: Jennifer Hamann said costs will be modest (cleanup, crew delays, lodging, propane for switch heaters) with no significant customer shutdowns expected. Lost carloadings should be made up with two months left in the quarter.

STB Merger Update: What's Next?

The Surface Transportation Board (STB) determined additional information was needed after Union Pacific submitted approximately 7,000 pages in its initial application.

Three Areas Requiring Clarification:

- Additional documentation on specific merger benefits

- Competitive impact analysis details

- "Red line" walkaway provision disclosure

Timeline:

- Response preparation: "A few weeks"

- Refiling: Expected in March 2026

- Target closing: First half 2027 (unchanged)

Cash Position: Union Pacific will pay off $1.5 billion of long-term debt due in H1 2026, then conserve cash in anticipation of the merger closing.

How Did the Stock React?

Union Pacific shares rose +0.8% to $232.85 following the Q4 2025 earnings release, outperforming the broader market.

The muted reaction reflects the market's balanced view: strong operational execution offset by near-term pricing headwinds and merger uncertainty.

Key Takeaways

- Operationally strong, financially mixed: Record safety and service metrics, but operating ratio deteriorated on merger costs and inflation

- Full year delivered: 8% EPS growth to $11.98, best-ever operational performance, industry-leading ROIC of 16.3%

- Norfolk Southern merger progressing: STB requested clarification on 3 areas; refiling expected in weeks, still targeting H1 2027 close

- Conservative 2026 outlook: Mid-single digit EPS growth against muted economic backdrop; price "may not be a driver of improving margins"

- Capital allocation shift: Share buybacks paused ($4-4.5B) to conserve cash for merger; dividends continue

- Competition welcomed: Management supportive of reciprocal switching if implemented fairly

*Values retrieved from S&P Global